When asked what he viewed as mankind's greatest invention,

Albert Einstein reputedly replied, “Compound interest is the

Eighth Wonder of the World. He who understands it, earns it;

he who doesn't, pays it.”

Compounding lays the cornerstone of good investing and can

be separated into two sub-components: performance and fees.

It’s a delicate balance. Like rearing a delicate flower, space

must be provided for investment flair and talent to bloom,

while set within a consistent and carefully controlled

environment.

Get this balance wrong and the small seedlings will do poorly;

they may even die.

Get it right and they will grow into fabulous forests and

remarkable portfolios.

1.

The power of compounding

Something we learned running hedge funds, and something we

didn’t expect at all, was how often we kept running into some of

the world’s most successful endowments, pension funds, and

sovereign wealth funds; all beating similar paths through the

financial undergrowth.

So, we thought about why this was, and gradually realised that

almost all these top performers shared four key attributes.

Our aim is to harness these same attributes and make them

available to you, the retail investor, at a price you can afford.

We often hear about wealth manager ‘mates’ entrusted to

look after people’s money and to choose suitable funds for

them. That’s a heck of a lot of trust!

Because, according to S&P Dow Jones, over the past 10

years 87% of active European equity funds

underperformed the S&P Europe 350 Index and 95% of US-

funds underperformed the S&P 500.

These results are bleak. Yet, European regulators find retail

investors still struggle to obtain basic information

regarding how much their pot has grown, their charges,

and whether their expectations have been met.

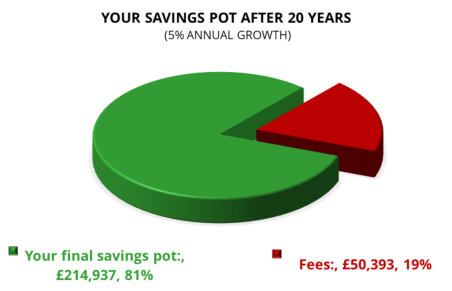

IInvest £100,000 at 5% annually, and it will grow to £265,330 in

20-years. This represents a cumulative gain of 165%.

Now deduct typical total investment fees of 2.83% per annum*

and that same £100,000 will increase to just £153,627. Your final

pot is almost half the value it would have reached in the

absence of fees.

Over an average 38-year working life, fees can reduce your final

saving’s and pension pots by a staggering two-thirds, leaving

you to live out your retirement on the remaining one third.

That kind of maths astounded even Einstein!

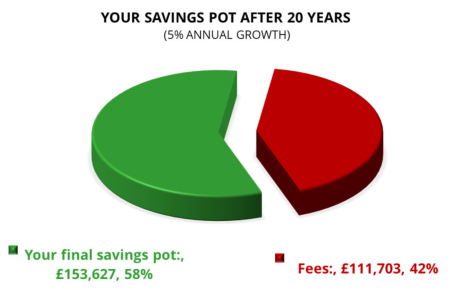

It is why, through innovation, investment, and operational

efficiencies, Eriswell keeps full-service wealth management

costs down to around 1.1%. This includes ongoing advice,

portfolio management, trading platform, administration, safe

custody, etc.

Our rates are over 60% below the 2.83%* per annum market

average.

2. Performance. It’s not good

enough to aim, you have to hit it

* Industry standard UK combined fees for a £100,000

investment are 2.83% per annum.

Decomposition as follows: 0.95% per annum Wealth

Management/IFA advice; 1.25% p.a. active fund management

fees (OCF + hidden transaction charges); and 0.63% per

annum additional fees, including inter alia entry/exit fees,

bid/offer spreads, and administrative charges.

Sources: FCA, ESMA, Market estimates.

How standard fees of 2.83% p.a.

destroy your savings over time

Control frameworks are your north star, a dependable point

of reference which governs the evolution of your portfolio

through time.

This star must never dim as the results are rarely good.

Control weaknesses come in many guises, but arguably the

most worrying are the persistent failures which follow an

organisation’s instinct to protect itself and its reputation

above all else.

To paraphrase Lincoln: effective control systems must be of

the individual, by the individual, and work for the individual

not their service providers.

Eriswell’s control frameworks have been designed to meet

this test.

4. Control Frameworks

3. Fees. More dangerous than any crash!

Chart 1: MARKET STANDARD FEES of 2.83%* p.a.

Chart 2: ERISWELL FEES of 1.10% p.a.

Hallmarks of a successful portfolio

T: +44 (0) 1932 240 121

E: info@eriswell.com

For general enquiries, please contact us by

email or telephone.

We look forward to speaking with you soon.

Contact your support team