The rise and fall of GameStop (GME) are characteristic of a late-phase bull market in which

human emotion plays an increasing role. More strikingly, this is the first-time markets have

witnessed an army of retail investors intentionally sacrifice themselves to the cause of

taking down professional investors.

“With the Reddit Army forced into retreat, discipline can now be restored”, so say the talking

heads who pop-up at such times. An absurd prognosis which clashes with any reading of

history: the 1848 Peasant Revolutions, Russian Revolution, or even the US Civil War.

Why are professionals so obsessed with ‘discipline being restored’? It is because the

entire finance industry is built upon notions of rationality and efficiency, which are

definitionally blind to dysfunctional episodes like GameStops, where securities detach

themselves from any notion of rational fundamental value.

As a consequence, outbreaks of get-rich-quick fever are dismissed by market professionals

under the ‘bubble’ catch-all, passing psychotic episodes which ‘serious’ investors must

accept as an unavoidable hazard of investing. We will see how this thinking caused many

great investment opportunities to me missed by market professionals and nobody should

be in the least bit surprised at this.

Quite simply, if one doesn’t understand where something is coming from, how it behaves,

and its direction of travel, how can one possibly forecast its journey into an uncertain

future? In such circumstances, traditional finance needs to be sealed in a box with a label

reading:

“Do not open until rationality returns!”

Now ask yourself some more worrying questions: What if GameStop, Bitcoin, et al are

metaphors for the market as a whole?

What if slavish index buying is forcing investors to inadvertently buy into stocks which

have become detaching themselves from reality?

What if a wider stock market bubble is developing in front of our own very eyes and goes

on to infect say residential housing? The behavioural and psychological aspects of financial

bubbles have rarely been more pertinent than they are today.

What defect in the human mind facilitates the formation of financial bubbles in the first

place? Historically, we know only one thing for certain – they ultimately burst.

And finally, why are we collectively so susceptible to being swept up in the mania of it all?

The story so far

Let’s quickly review the existing literature. Werner De Bondt, a founding figure in

behavioural finance, argues that bubbles are often the product of movements in interest

rates or changes in macroeconomic forecasts. He adds to this investors’ inbuilt propensity

to see patterns which don’t exist and to expect that, if a price is going up, it will continue to

do so.

The formation of asset price bubbles often boils down to 3 key factors:

1.

An economic shock that reflects structural change outside the experience of most

people, which objectively justifies a higher price (“new paradigm”)

2.

Rising investor confidence.

3.

A herding effect, where demand increases because prices are going up

All three are clearly visible today.

Peter Earl posits that speculative asset price bubbles are the consequence of the adoption

of new investment decisions and techniques taken up by professionals and, as these new

rules and processes are passed from expert investors to the general public, the rules

become degraded and diffused. Novice investors, he argues, pick up filtered down and

less effective versions of investment strategies as a boom gets underway. Which only

further adds to the hype.

What Earl is referring to here is what we and others call the ‘meso-layer’, and in normal

times it is principally of academic interest. Today’s world is however anything but normal.

Recent developments in the meso layer are of vital importance to stock investors, for this

layer is home to CAPM, sector classifications such as value and growth, P/E comparables,

CFA courses; almost everything we know about asset pricing and valuation.

Key Facts about the meso layer:

•

The meso layer embraces the totality of human interactions: technologies, institutional

behaviour, behavioural factors, etc. New investment rules are continually born here

while others become extinct. New ones diffuse through the investment community via

a system of carriers and interlinkages with pre-existing rules. Importantly, this process

of continual evolution does not empirically and should not theoretically tend towards

the adoption of a single superior rule of investing.

•

The evolution of new rules has the potential to radically alter traded asset prices and

many new rules are evolving as investors grapple with this new central bank

dominated zero-r* environment.

•

Post-2009 The emergence of these new rules has repeatedly caught the experts offside

and 2020/21 have been no exception. To such an extent that novice investors have lost

confidence in the famous names, top analysts, and renowned strategists they once

looked up to. ‘Expert’ mistakes have included fluffing the internet and personal data leg

of the 3rd phase of the industrial revolution (FAANGs), missing the powerful rally in

NGDP-tracking stocks, and failing to recognise that European banks have become

tradable but not investable assets.

•

Central bankers are the new ‘trusted experts’ who guide expectations and force market

valuations in a zero-r* world. And yet central banks’ primary interest isn’t helping the

markets to discover fair asset prices; it is corralling asset prices to a level consistent

with their given mandates.

•

Can central banks keep on doing this in perpetuity? We doubt it, but that’s beyond the

scope of this article.

Back to the theory of bubbles:

Behaviouralists argue that belief and optimism is the fundamental factor in driving asset

price bubbles. Which makes sense because the price of an asset in a bubble can exceed

the valuation of even the most optimistic investor in the world. This is only possible since

the current optimistic investors – those who own the stock – have the option to resell the

asset in the future at a higher price if they become less optimistic. They are selling to new

buyers who in turn will be optimistic about the future of that stock.

According to this idea, bubbles form simply because a sense of unrealistic optimism

oscillates between different investor groups who pass the stock between them.

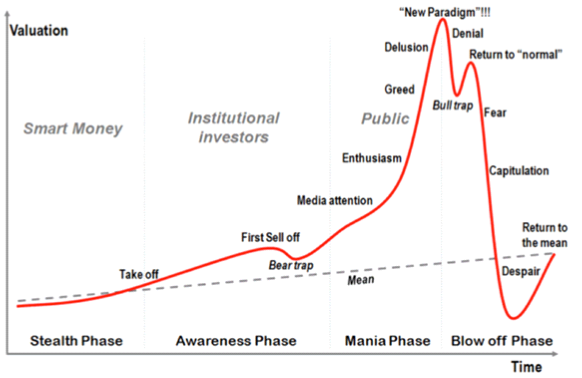

Source: Wikimedia

The classic chart above illustrates how this works. A sense of collective enthusiasm tends

to accompany a stock which receives media attention. What continues to drive the asset

far above its fundamental value is purely psychological in nature: people become

enthusiastic about the asset primarily because they have invested in it, and it keeps going

up because enthusiastic investors continue to invest. Ad infinitum until the bust beckons.

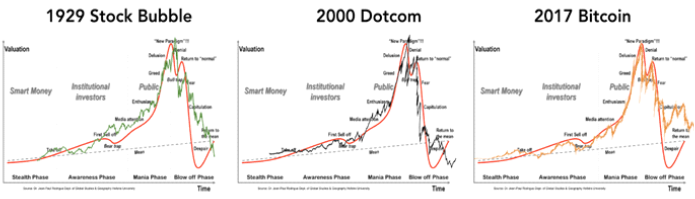

Many of the financial bubbles throughout history can be aligned to this rough path.

This is by no means an extensive list. Much has been written on financial bubbles, and the

one thing they all have in common is the recognition that they are largely psychological in

nature – that is, the bubble is driven by the human mind and human behaviour.

A more curious question here might therefore be: what is going on in our brain when we

make decisions – decisions which, taken collectively, cause bubbles to form?

Why you can't resist chocolate

The best dieting advice turns out to be that you should always give yourself healthy

alternatives to choose between. When you want to eat a bar of delicious chocolate, never

frame the question: should I or shouldn’t I eat the chocolate? It is too big of a strain on

your willpower and you will likely lose.

Instead, you should frame the question thus: Do I want this chocolate or an apple? In

other words, if you give yourself more options than just the chocolate itself, you are far

more likely to take the healthier option.

The reason this happens is because our brains respond in a dynamic way, and therefore

we make different choices, depending on the options we are presented with. The best

dieting advice turns out to be that you should always give yourself healthy alternatives to

choose between. When you want to eat a bar of delicious chocolate, never frame the

question: should I or shouldn’t I eat the chocolate? It is too big of a strain on your

willpower and you will likely lose.

Three critical players

When it comes to the decisions we make, three of the critical players in our brains are:

1.

The nucleus accumbens. Its job is to say, “I want this and I want it now”. This primitive

part of our brain thinks only in terms of reward, making us spend our money or eat

junk food when perhaps we don’t really want to. It is the greedy part of the brain.

2.

The amygdala, which is responsible for the opposite. Its job is to ask, “what are the

consequences?”. It is the scared part of the brain.

3.

The orbitofrontal cortex. Its job is to weight up the costs and benefits of a decision by

listening to the greedy and scared parts of the brain before deciding which way to go.

It is the logical part of our brains.

These different brain areas interact in different ways depending on how we approach the

decision-making process. The reason we eat the chocolate when it is the only option we

have is because the greedy brain is too enticed by the immediate calorific reward.

The reason that we can (sometimes) resist the chocolate in favour of the apple is because,

faced with multiple options, both the greedy and fearful parts of our brain offer competing

sides of the argument. The logical part of our brain then decides who to listen to and we

are more able to exercise willpower.

But what does this teach us about the formation of bubbles?

It turns out that the logical part of our brain is very competent at collecting information

between alternative or competing options. It is not so good, however, at battling against

the greedy parts of the brain when only one option is involved.

Choosing between the chocolate and the apple is equivalent to normal market conditions,

where we have a range of asset classes to invest in and therefore a range of choices to

make: Should I invest in bonds? What about Stocks? Or Property? Because we have

options to choose from, we naturally perform a cost benefit analysis which harnesses the

logical parts of our brain before reaching a thoughtful and informed decision.

Financial bubbles present a reduced choice

Bubbles tend to reduce our choice, sometimes down to just to one. This may be due to

overrepresentation and the type of mass media hysteria which surrounded the 2000-2004

Sydney housing bubble, Ireland’s Celtic Tiger, and the dot-com bubble; or it might

surround the emergence of new and unique assets like FAANGs.

Another key feature, as it has been since mid-2020, is the collapse in bond yields to near-

zero or below. This effectively removes the safe-haven status of sovereign bonds and

thereby further reduces choice. Long dated government bonds after all used to yield

around 6%, a reasonable proxy for nominal GDP, the traditional wealth preservation

benchmark. Today most G-8 government bonds yield below 1%. Choice is further reduced

by QE, the process by which central banks have bought significant quantities of

government bonds.

In parallel to this, the momentum of asset class rallies offers investors the temptation of

immediate financial gain. With our options reduced to either a rapidly rising stock

(metaphorical chocolate bar) or nothing at all, the greedy parts of our brain are prone to

being swept away with temptation.

This is especially true for stocks like GME, where the price explosion itself was driven by

collective retail investors banding together on Reddit with the explicit aim of taking on the

hedge funds. The subsequent 1,800% explosion in stock price, augmented by a “do try this

at home” mentality, caused many retail investors to believe that this was a once-in-a-

lifetime, single event, do-or-die investment opportunity.

When our choice is limited to jumping on a train or watching it pass us by, we jump.

The crux of the matter is that, for whatever reason, financial bubbles are characterised by

reduced choice – or at least the illusion of reduced choice. Greed therefore dominates the

decision-making process without consulting logic, causing ordinarily sensible people to

make risky investments which they never normally would.

Frame investment questions differently

The truth is that it’s all about framing. As Nassim Taleb observed, “the way a question is

phrased is information itself”.

Some academic studies have found that reframing a question can reduce mispricing. For

example, if gold investors know they are buying a mine with depleting reserves, it reduces

their willingness to pay for overpriced assets.

The same applies to novice investors if we show them maximum theoretical values in the

form of a graph. By drawing attention to fundamental values, we emphasise the illogicality

of inflated prices.

When we approach a decision in ‘normal’ rational market conditions (chocolate and apple),

the range of options means that we tend towards a logical and measured approach. But to

simply frame the question “should I/should I not invest in this rising asset?” (i.e. chocolate

only) is doing ourselves a psychological disservice because we must battle primitive areas

of the brain which crave instant reward and we make it difficult – even impossible – not to

succumb to temptation.

Conclusion

Right now, the only legitimate advice for holding the logical high ground is to pay attention

to fundamental values and never reduce your options down to just one. Which is fair

enough, but is holding the logical high ground a good idea in current circumstances?

There is an angry crowd out there as this central bank supported rally has created ‘haves’

and ‘have nots’. Which opens the risk that purely logical investors run headlong into

Keynes’ paradox: “The Market Can Remain Irrational Longer Than You Can Remain

Solvent”. For the non-purists who simply want to remain solvent – a copy of Gustave Le

Bon’s 1895 work, "The Crowd: A Study of the Popular Mind” might make better reading.

On which note, our advice is to stay focussed on the behavioural forces which are actually

driving markets today, instead of what should be driving them in the utopian rational

paradise imagined by conventional finance.

And finally, every bubble contains the seeds of truth and some of those seeds will grow

into the opportunities of tomorrow.

Matthew S. Machin

MINDS AND MARKETS

Psychology of Financial Bubbles and

Why They Tempt Us

Demystifying the relationship between psychology and finance

BY MATTHEW S. MACHIN

| Market Psychology Series #5

| 12 February 2021

Photo by Marc Sendra Martorell on Unsplash