The expert investor who never loses money, the doctor who never misdiagnoses, or the

athlete who never misses a shot: many of the people we idolise are experts in their fields.

Regardless of the field you are in, reaching the top of your game is an appealing goal to

everyone.

But is mastery always a good thing?

According to Allan Snyder it might not be. Research he conducted in 2011 suggests that

our expertise can blind us to new solutions.

The experiment

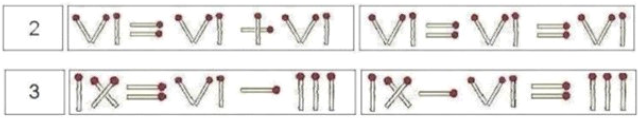

Participants in Snyder’s study were asked to sit down and solve 27 “matchstick arithmetic”

questions. They were told that they could only move one matchstick.

The task involved roman numerals, with a false statement which they had to correct (left).

In this case it would involve moving one of the matchsticks to turn IX into IV, thereby

changing the statement from the incorrect 3 = 9 – 1 to 3 = 4 – 1.

Although the first few problems would take candidates several minutes to solve, they soon

spotted that the formula for each round was exactly the same. It was just a case of turning

an X into a V or vice versa. The candidates then proceeded through the remaining 27

rounds with ease.

However, half of the participants hit a stumbling block in the next round when the

problem changed:

80% of the participants failed to solve these type-2 and type-3 problems, which required

changing a + to = or a – to =. After several minutes, the majority of participants failed to

come up with a new solution once they realised that the old one no longer applied.

But here is where it gets interesting. The other half of the participants were given electric

brain stimulation before they moved from type 1 to type 2 and 3 problems. This

stimulation was designed to temporarily disable parts of the left cortex and excite parts of

the right cortex.

Why?

The left part of the cortex is responsible for maintaining existing beliefs, blueprints,

models, or strategies, whereas the right part of the cortex is responsible for spotting new

things and updating the left side.

Snyder hypothesised that by disabling the part of the brain responsible for holding onto

existing strategies and enabling the part of the brain responsible for coming up with new

insights, participants would be better at the type 2 and 3 problems.

And he was right.

3x as many from the group who underwent brain stimulation figured out the new solution

to the type 2 and 3 problems.

Your brain's best strategy

Whether you are trying to decide on an investment strategy, forecasting an economy,

designing tactics for a football game, or trying to solve matchstick arithmetic’s, your brain’s

job is the same: to solve problems. The brain is a computer that is always trying to find

solutions.

As we solve more and more of the same kind of problem, your left cortex stores that

information like an algorithm. The reason that the candidates get quicker across the first

27 problems is because they have stored an internal model in how to solve this problem

using a single strategy.

The brain then looks at every subsequent problem and says, “excellent, I’ve seen this

before”, and proceeds to implement the solution that works.

How many times have we heard the expression “practice makes perfect”? We only get

good at something because we get familiar with the rules and the optimal strategy

required.

The problem occurs when the rules change. Participants were baffled by the new

matchstick problem because they had already built a rigid problem-solving model which,

once it no longer applied, left them fresh out of ideas.

Financial markets are no different.

Witness the resistance among academics and financial professionals to accepting that the

rules of markets are fundamentally changed by near-zero interest rates. Most prefer to

rely on outdated models instead, which were designed and calibrated in a pre-2008 GFC

(global financial crisis) environment. One which bears little resemblance to markets today.

Zero interest rates in turn affected the interplay between financial phenomena such as

inflation, deficits, and government bond yields, and perhaps most importantly, they deeply

affect human behaviour. These changes went on to overturn conventional notions of stock

valuation, with banking, technology, fast-moving consumer goods companies (FMCGs) and

‘value’ stocks being notable examples.

Trouble ultimately came in many sizes to those who refused to accept; witness the recent

litany of mistakes made by so-called financial experts. Their error strewn ways have

underpinned the explosion of low-cost exchange traded funds (ETFs) and a new do-it-

yourself mentality amongst retail investors.

For example, a study of end-of-year USDEUR exchange-rate predictions over a 10-year

period, made by 22 prominent international banks (Goldman Sachs, JP Morgan Chase,

Citibank, Barclays, etc.) found that they missed every single major direction change, and

that the final year-end exchange rate fell outside the range of all 22 forecasts over 50% of

the time.

Returning to the matchstick tests, the reason participants who underwent brain

stimulation fared much better in the subsequent test is because their brain temporarily

lost the ability to implement pre-conceived matchstick models. With this capacity disabled,

they were more open to new and innovative solutions.

The economist John Maynard Keynes reached a similar conclusion in respect to the

financial markets which followed the Great Depression of 1929-1933:

“The difficulty lies not so much in developing new ideas as in escaping from old ones.”

What does this teach us?

The job of our left cortex is to store information and construct models. The only problem

with this however is that these internal blueprints get left behind when the rules change,

and we lose our ability to innovative.

Whether you a CEO, a leader in your industry, or the manager of a small team, the lesson

to be found here is that your experience might be the thing which makes you an expert,

but it is also the thing which can blind you to new insights.

There is a reason that some of the key scientific discoveries throughout history have been

made by people like Steve Jobs and Albert Einstein who developed their maverick ideas

with little deference to received wisdoms. Einstein believed that while creativity was not

something that could be taught, it was nevertheless something that can be harnessed and

embraced through what he referred to as ‘combinatory play’.

A concept Steve Jobs embraced when he observed:

“Creativity is just connecting things. When you ask creative people how they did something, they

feel a little guilty because they didn’t really do it, they just saw something. It seemed obvious to

them after a while.”

The famous French mathematician Jacques S. Hadamard was similarly fascinated by the

process of human creativity, why some people were so good at it, and others not so much.

In 1946, he wrote to Albert Einstein while researching his new book, “The Mathematician’s

Mind: Psychology of Invention in the Mathematical Field”:

“Dear Albert,

“It would be very helpful for the purpose of psychological investigation to know what internal or

mental images, what kind of “internal words” mathematicians make use of; whether they are

motor, auditory, visual, or mixed, depending on the subject which they are studying.

“Especially in research thought, do the mental pictures or internal words present themselves in

the full consciousness or in the fringe-consciousness?

Here is Einstein’s response (it is well, well worth a read):

“My Dear Colleague:

“In the following, I am trying to answer in brief your questions as well as I am able. I am not

satisfied myself with those answers and I am willing to answer more questions if you believe this

could be of any advantage for the very interesting and difficult work you have undertaken.

“(A) The words or the language, as they are written or spoken, do not seem to play any role in

my mechanism of thought. The psychical entities which seem to serve as elements in thought

are certain signs and more or less clear images which can be “voluntarily” reproduced and

combined.

“There is, of course, a certain connection between those elements and relevant logical concepts.

It is also clear that the desire to arrive finally at logically connected concepts is the emotional

basis of this rather vague play with the above-mentioned elements. But taken from a

psychological viewpoint, this combinatory play seems to be the essential feature in productive

thought — before there is any connection with logical construction in words or other kinds of

signs which can be communicated to others.

“(B) The above-mentioned elements are, in my case, of visual and some of muscular type.

Conventional words or other signs have to be sought for laboriously only in a secondary stage,

when the mentioned associative play is sufficiently established and can be reproduced at will.

“(C) According to what has been said, the play with the mentioned elements is aimed to be

analogous to certain logical connections one is searching for.

“(D) Visual and motor. In a stage when words intervene at all, they are, in my case, purely

auditive, but they interfere only in a secondary stage, as already mentioned.

“(E) It seems to me that what you call full consciousness is a limit case which can never be fully

accomplished. This seems to me connected with the fact called the narrowness of

consciousness.

“Remark: Professor Max Wertheimer has tried to investigate the distinction between mere

associating or combining of reproducible elements and between understanding (organisches

Begreifen); I cannot judge how far his psychological analysis catches the essential point.”

Conclusion

Perhaps Jobs and Einstein illustrate that it is people either working outside of our industry,

or visionary mavericks working within it, people who have yet to construct rigid strategies

and blueprints, who might be the ones to offer the fresh and innovative perspective we

are looking for.

One consequence of the expansion of the financial "academic" sector over the past 20

years, and the blizzard of financial courses and qualifications now available, is an army of

people overeducated in the world of yesteryear.

People who need to be kept occupied and one of the main activities they end up doing is

“investment research”.

I put this in quotes because success within this system derives from reheating existing

theories and ideas rather than engaging in original and innovative thought. Or horror of

horrors, questioning conventional thinking with respect to the cornerstones of modern

finance including CAPM (capital asset pricing model), efficient market theory, and so on.

It is depressing to see the games still played to satisfy this system as opposed to moving

forward and consequently the miserable quality of what is considered acceptable

research. Much is formulaic, lacking in originality, and sometimes plain wrong, but bank

compliance and legal departments love it. This is because it is easier to supervise, defend

against legal and regulatory challenge, and a good way to keep work completion rates

high, the flipside of that wretched, “look how hard we work mantra”.

Matthew S. Machin

MINDS AND MARKETS

How Experts can be Blind to Innovation

Demystifying the relationship between psychology and finance

BY MATTHEW S. MACHIN

| Market Psychology Series #6

| 9 April 2021

Photo by Anne Nygård on Unsplash